The Big Difference Between Renter and Homeowner Net Worth

Some Highlights

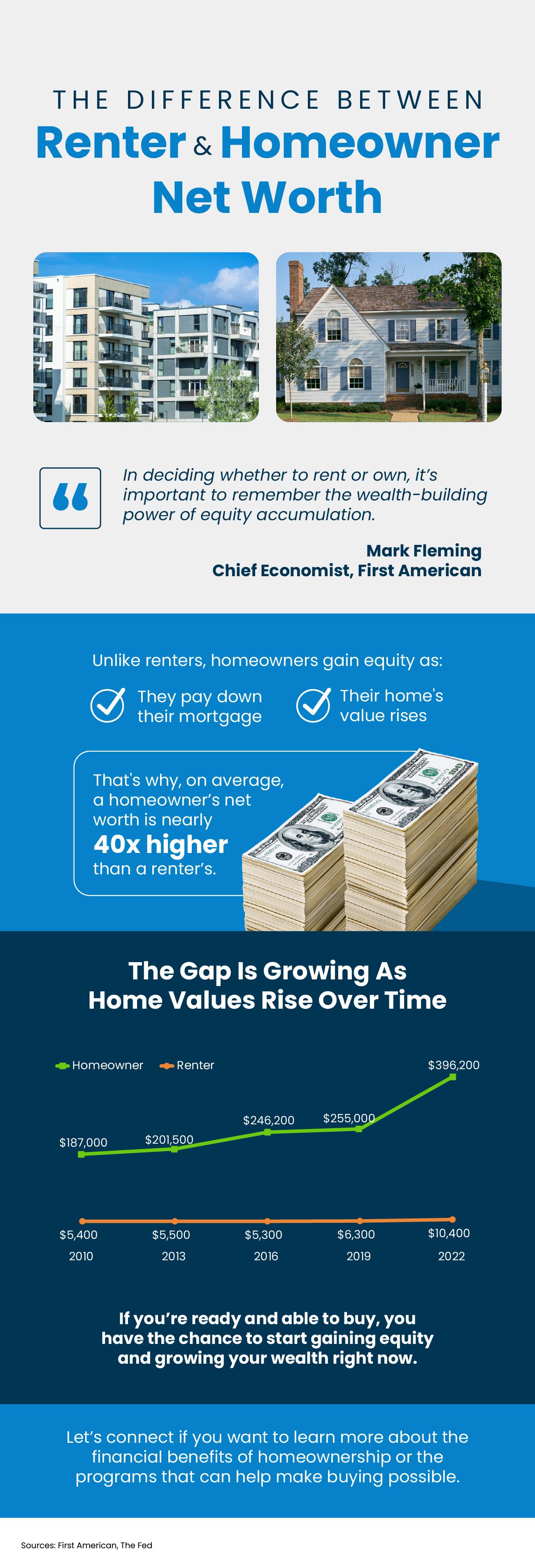

- If you’re torn between renting or buying, don’t forget to factor in the wealth-building power of homeownership.

- Unlike renters, homeowners gain equity as they pay their mortgage and as home values rise. That’s why, on average, a homeowner’s net worth is nearly 40x higher than a renter’s.

- Let’s connect if you want to learn more about the financial benefits of homeownership or the programs that can help make buying possible.

Categories

Recent Posts

Ryan Serhant & Barbara Corcoran on the 2025 Housing Market: What Buyers & Sellers Need to Know

Buying vs. Renting in St. Louis: Which One Makes More Financial Sense?

10 Reasons to LOVE Owning a Home in St. Louis

The Hidden Cost of Homeownership in St. Louis: Are You Financially Prepared?

The Big Difference Between Renter and Homeowner Net Worth

Don’t Let These Two Concerns Hold You Back from Selling Your House

What’s Behind Today’s Mortgage Rate Volatility?

Is Wall Street Really Buying All the Homes?

Don’t Miss Out on the Growing Number of Down Payment Assistance Programs

Mortgage Rates: Past, Present, and Possible Future